As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets. At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation. This long-form equation is called the expanded accounting equation. This arrangement is used to highlight the creditors instead of the owners.

What is the difference between an asset and a liability?

So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity). Under the accrual become a xero advisor basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

Why You Can Trust Finance Strategists

The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity. For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). With the accounting equation expanded, financial analysts and accountants can better understand how a company structures its equity. Additionally, analysts can see how revenue and expenses change over time, and the effect of those changes on a business’s assets and liabilities. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity.

Expanded Accounting Equation: Definition, Formula, How It Works

Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash). After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment. Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems.

- Receivables arise when a company provides a service or sells a product to someone on credit.

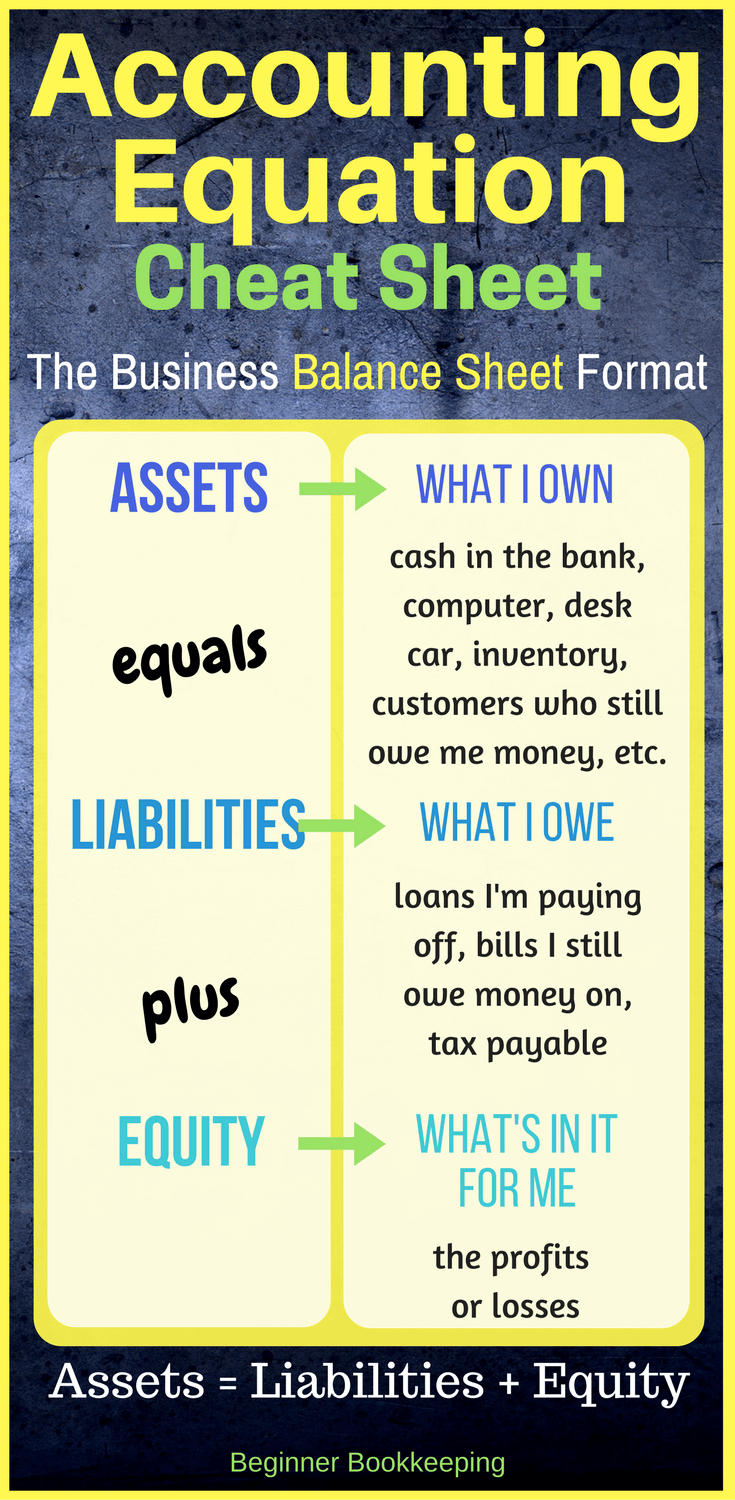

- The formula defines the relationship between a business’s Assets, Liabilities and Equity.

- It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business.

- “Members’ capital” and “owners’ capital” are commonly used for partnerships and sole proprietorships, respectively, while “distributions” and “withdrawals” are substitute nomenclature for “dividends.”

- If assets increase, either liabilities or owner’s equity must increase to balance out the equation.

Understanding how to use the formula is a crucial skill for accountants because it’s a quick way to check the accuracy of transaction records . Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity. Assets represent the valuable resources controlled by a company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. If an accounting equation does not balance, it means that the accounting transactions are not properly recorded.

Everything You Need To Master Financial Modeling

The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. This transaction brings cash into the business and also creates a new liability called bank loan. This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation. On 2 January, Mr. Sam purchases a building for $50,000 for use in the business.

Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. Assets entail probable future economic benefits to the owner. As business transactions take place, the values of the accounting elements change. The accounting equation nonetheless always stays in balance. The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded to represent the amount now owed to the supplier.

The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. The fundamental accounting equation, as mentioned earlier, states that total assets are equal to the sum of the total liabilities and total shareholders equity. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts.

This shows all company assets are acquired by either debt or equity financing. For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity. The accounting equation relies on a double-entry accounting system.